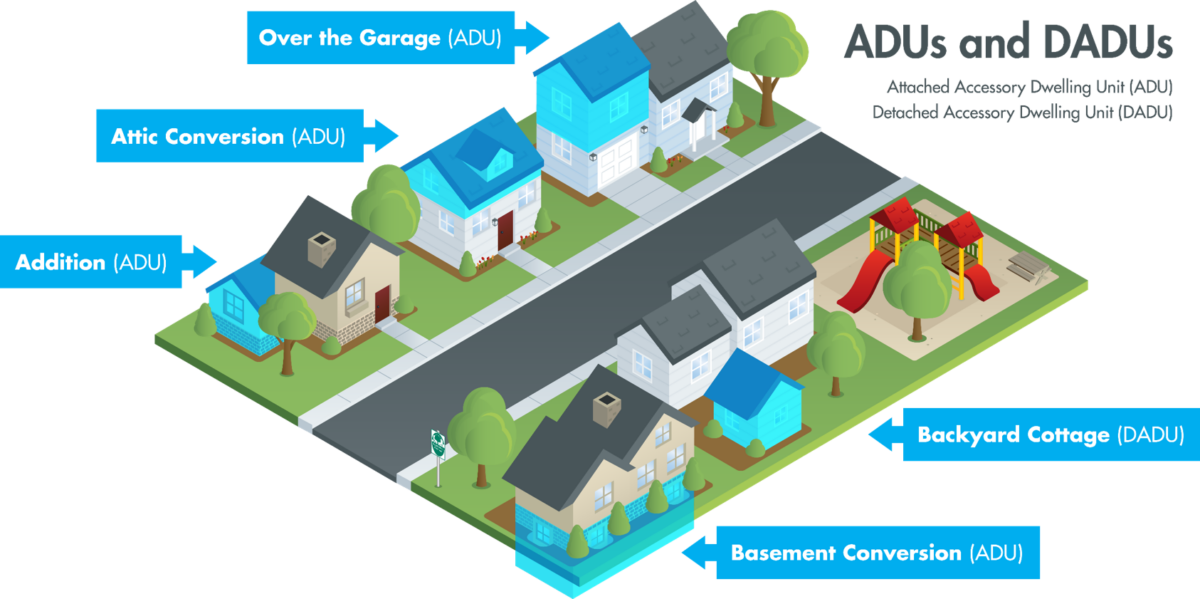

What is an Accessory Dwelling Unit?

An accessory dwelling unit (ADU) is a small, self-contained residential unit located on the same lot as an existing single-family home. Accessory dwelling units include basic facilities needed for day-to-day living independent of the main home and include a living space, kitchen, sleeping, bathroom, and have a lockable entrance door.

Forms of ADUs

Benefits of ADUs

Affordability – More modest, affordable home choices in all our communities.

Opportunity – More options for people of all incomes to live near jobs, schools, transit, and parks.

Flexibility – Freedom for homeowners to age in place, care for family, and earn income from a small rental.

Stability – Build economic security and housing stability for middle and low-

income families with workforce housing near jobs.

Sustainability – Small, efficient homes in existing neighborhoods help prevent sprawl, cut traffic and commutes, tame infrastructure needs, and fight climate change.

Responsibility – Every community has a part to play, allowing homes that work for

families across the state.

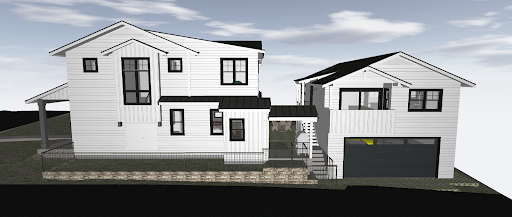

By Page and Beard Architects

By Magellan Architects

By My Kabin

Income Models*

Renting out the ADU

• Short-term rental

• Long-term rental at market rates.

• Provide housing to family or friends at lower than market rates or free

Renting out the Primary House

• Live in ADU and rent out the primary house at market rates

• Live in ADU and rent out primary house to family or friends at lower than

market rate.

Renting out both the ADU and Primary House

• Rent out both the ADU and Primary house separately at market rates

• Only allowed with no owner-occupancy requirement

*Every jurisdiction will have unique regulations that specify what type of rentals are allowed.

Accessory Dwelling Unit Financing Options

Cash/Other Investments/Family Gifts

Description: Using cash from savings account. Liquidating stocks and bonds in investment accounts.

Advantages: Low cost. No origination fees or interest chargers. Cash readily available.

Limitations: Cash-Need sizable cash amount + $200,000. Investments-Give up future gains.

Construction/Restoration Loan

Description: Short-term transition loan used to build.

Advantages: Do not need to access home equity. Loan uses the house being built as loan collateral. Some construction/restoration loans may be converted to long-term mortgage after house is completed.

Limitations: Initiation and other loan fees higher than traditional mortgage and HELOC. Higher interest rates charged and larger down payments than traditional mortgages. Amount of loan depends on buyer’s income and project cost/market value. Some construction loans may require the balance to be paid off in full once the project is completed.

Home Equity Line of Credit (HELOC)

Description: Revolving credit line for a pre-approved maximum amount with a variable interest rate. The amount of the HELOC is based on the amount of home equity and income resources.

Advantages: Access home equity. Ability to draw on credit line whenever you need it. Don’t pay interest on unused credit line. Very low initiation fees.

Limitations: Credit line is limited by home equity amount and income qualification. HELOC may be revocable.

Cash Out Mortgage Refinance

Description: Refinancing home mortgage for a greater amount than existing mortgage balance (take cash out).

Advantages: Access home equity. Low to moderate initiation fees and interest rate. Long-Term fixed rate loan.

Limitations: Amount of cash out depends on home equity amount and income qualification.

Reverse Mortgage

Description: A loan to access home equity using the residence as collateral for mortgage. May take out cash up front and/or set up line of credit.

Advantages: Reverse mortgage does not require monthly payments of principal and interest. Improves cash flow. Line of credit is irrevocable and increases over time. Mortgage is not income qualified.

Limitations: Home must be owner occupied and borrower must be age 62 or older. Amount of the mortgage is limited by amount of home equity and the age of homeowner/borrower. Origination fees are very high and

interest rate charged is higher than traditional mortgage.

401K Plan Retirement Accounts

Description: Tax advantage retirement savings and investment account.

Advantages: Many plans allow participants to borrow cash out and make loan payments back into their account. Tax free transaction.

Limitations: If allowed loan amounts are limited to 50% of account value with $50,000 maximum limit.

Developer Financing

Description: Developer provides different financing models for leasing the land and participates in appreciation and rental income.

Advantages: Ability to finance and build if the homeowner does not have the time, money, or expertise.

Limitations: Developer shares in the profits.

IRA Retirement Accounts

Description: A tax advantage retirement savings and investment account.

Advantages: May make one time cash distributions of the build or ongoing distributions to qualify for a loan’s income requirement.

Limitations: Distributions may be taxed as ordinary income (higher tax rate)

Condominiums Property

Description: Property is divided into Condos which are then sold separately.

Advantages: Homeowner’s property may be worth more when divided. Provides affordable housing.

Limitations: Attorney should handle the process. Home is sold as a condo and not a single family home. Verify zoning regulations.

Build Your ADU Team

Depending on the complexity and type of ADU construction, your team may include a realtor, architect/designer, contractor, engineers and landscape architects. The best team members will have passion, knowledge and experience in small-space residential projects.

Some prefab and modular companies provide turnkey solutions that take the project from start to finish. This model may work well for you if you do not require customization.

Costs

The average cost to build an ADU varies significantly depending on the structural types and the amount of customization:

• Internal ADU

• Garage Conversion

• Basement Conversion

• Detached New Construction

Setup Costs

• Permits and reviews

• Impact fees

• Architecture/design (N/A if Prefab)

• Engineering

• Site work/prep (DADU)

• Structure

Operating Costs

- Insurance

- Financing costs

- Increased taxes

- Maintenance/vacancy

Timeline to Design and Build

The average timeline to design and build an ADU or DADU can range widely from a few months to over 2 years depending on the jurisdiction, type and customization. An internal renovation in an ADU friendly jurisdiction may be completed in weeks while a fully customized DADU could take over 2 years to design, permit and build.

Some jurisdictions are currently evaluating their permit processes to become more ADU friendly. This may include providing off the shelf pre-approved plans and models that do not need additional approvals cutting weeks out of the permit process.

Permits*

Types

• Building

• Electrical

• Mechanical

• Plumbing

• Side Sewer

• City / Municipal License

*Depending on the jurisdiction, you will need to submit an ADU application, construction addition/alteration permit or comparable building permit. In addition, any electrical, mechanical, plumbing, and sewer work will require standard permits.

Benefits

• Helps protect your property value

• Compliance with building code

• Makes selling your property easier

• Improves safety

Separate Mailing Address

All mail for both units can be delivered to a single mailbox or a separate dedicated mailbox. Check your local post office to set up a dedicated mailbox.

Insurance

Insurance can be obtained for the ADU. The additional cost per year can range between $200-$500 to cover the additional structural replacement and liability costs. Call your insurance company to obtain rates.

Helpful ADU Resources

• A Regional Coalition for Housing: www.archhousing.org

• Master Builders of King and Snohomish Counties: www.mbaks.com

• Portland ADU site: www.accessorydwellings.org

• AARP: www.aarp.org/adu

• Sightline, a local think tank: www.sightline.org

• City of Seattle: www.seattle.gov/sdci/permits/common-projects/accessory-dwelling-units

• Backdoor Revolution: The Definitive Guide to ADU Development, by Kol Peterson

Contact Brenda or Art Nunes to Discuss Your Unique Situation!

Real Estate Managing Broker, REALTOR®

Certified ADU Specialist

Nunes Group | Keller Williams Eastside, Inc.

Real Estate Broker, REALTOR®

Certified Real Estate Analyst

Certified ADU Specialist

Nunes Group | Keller Williams Eastside, Inc.